Smart money moves can make your financial future more secure. These moves include refinancing student debt to get money for free or looking for a cheaper option to cable. Making these moves can improve your financial future by thousands of dollars per year. List the tasks you need in order to reach your financial goals.

Paying off high interest rate debt

You can make smart money moves to help you pay down your debt quicker. Ask your credit card issuer to lower the interest rate. The higher your interest rate, the harder it will be to make regular monthly payments. If you are able to present a realistic repayment plan, your credit issuer can lower your interest.

Another smart money move to make is to create a plan. A budget will help you save money and meet other financial goals. A budget will help you to pay your bills on time, create an emergency fund, save for retirement, and keep you from falling behind.

Investing

Smart money moves can improve your chances of financial success. Many investors have chosen not to ride the stock market's current roller coaster ride. If you follow these tips, you can avoid the same fate. This article does not offer investment advice. However, it highlights some of these smartest investments that have been made.

Before you make any investments, ensure you have the funds to pay them back. It is important to weigh the potential benefits and the risks. Make sure that you are financially stable, have a sufficient emergency fund, and can weather market fluctuations without having to withdraw your money.

Refinancing

There are many options to save money when refinancing your mortgage. It could save you thousands of dollars over your mortgage's life. You can also change your mortgage interest rate in real time, which can reduce your monthly payments. Investing for your future is another smart money move which can lead to financial security.

Although refinancing may be an option even for those with poor credit, you should always consult a mortgage professional in order to determine if it is right for you. Sometimes, refinancing allows you to trade a higher interest rate for a lower one, which can save you hundreds of dollars over the life of the loan.

Inscribing an emergency fund

Creating an emergency fund is a smart move if you're faced with unexpected expenses. You can invest your retirement savings and pay down debt with this fund. To increase your emergency fund funds, consider taking out a second or additional job.

Your expenses can be reduced to increase your emergency fund. For example, you can cut down on entertainment and dining out expenses to free up some money each month. To raise additional funds, you could also sell household goods.

Investing in a company-sponsored account

Saving money for retirement can be achieved by investing in an employer sponsored account. This will ensure that you have the right investments. An investor can view the performance on a statement. The employer is required by law to send this statement at least 4 times per year. Some plan administrators also offer educational materials and seminars for retirement planning. You can also get financial advice through a third-party advisory service, if you prefer.

FAQ

How do I start affiliate marketing as a beginner?

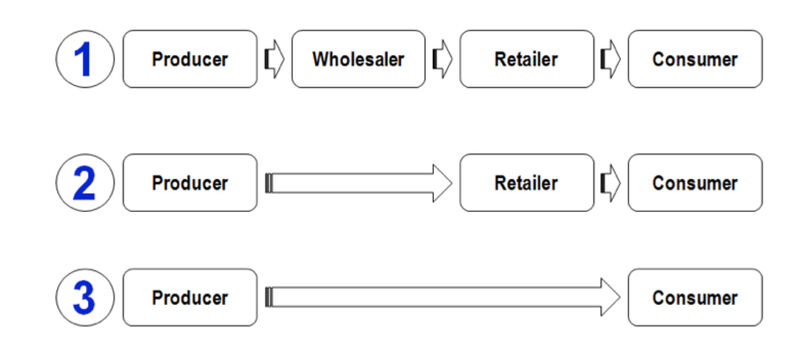

Affiliate marketing involves promoting products for merchants by affiliates. Merchants pay commissions to affiliates when customers buy their products. Affiliates earn money if their referrals purchase products.

Find a product that interests or you and start affiliate marketing. Look for companies that offer the same product. You can ask similar companies to partner with you if they sell similar products.

You can also make your own website to list products. Affiliate marketing is this. Because they already have a large audience of potential buyers, many people prefer to partner with established websites.

Once you have selected a product that you would like to promote contact the merchant. Let the merchant know why you think their readers would buy their product. Ask them to collaborate.

Negotiate the commission rate per sale with them if they are willing to agree. You should disclose any prior affiliations that you might have with the merchant.

How much do online affiliate marketers make?

The average annual income for an online affiliate marketer ranges from $0-$100k per year.

Most of these people are self employed and have their own websites.

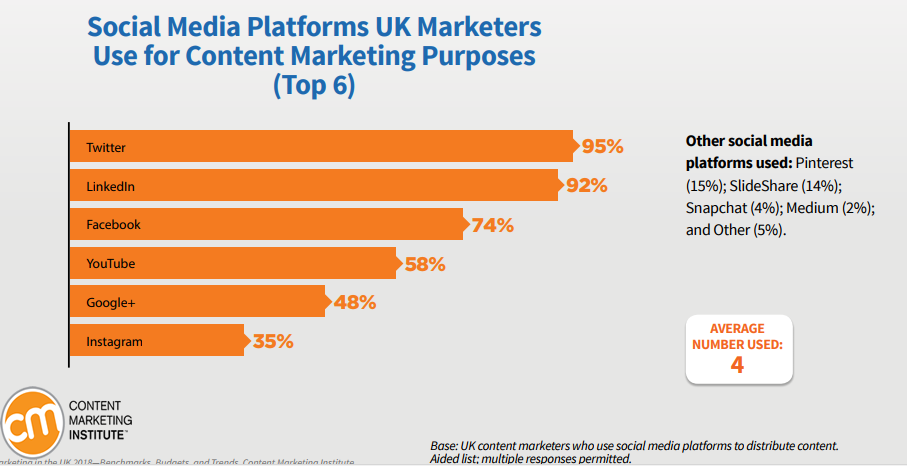

They use a variety methods to promote products on websites, such as text links and banner ads.

Affiliates can earn anywhere from $50 to $100 per sale.

Some affiliates could earn as high as $1000 per sale.

How do I make quick money online?

Many options are available to you if you're looking for ways online to make some extra money. You can try affiliate marketing, blogging or selling products on Amazon, eBay, Etsy, and eBay.

It is possible to open an e-commerce shop where you sell physical products such as books, clothing, electronics, toys, and so on.

If you have any previous experience, this is a great way for you to make money.

Statistics

- A recent study by Mediakix revealed that 80% of marketers find influencer marketing effective. (shopify.com)

- Some 70% of consumers say SMS is a good way for businesses to get their attention. (shopify.com)

- According to research by Marketo, multimedia texts have a 15% higher click-through rate (CTR) and increase campaign opt-ins by 20%. (shopify.com)

- According to the Baymard Institute, 69.82% of shopping carts are abandoned. (shopify.com)

- Backlinko found that the #1 organic result is 10 times more likely to receive a click compared to a page in spot #10. (shopify.com)

External Links

How To

These Tips Will Help You Become a Successful Affiliate Marketer

Affiliate marketing is a great way to make money online. There are a few things you can do to make affiliate marketing a success.

It is important to look for products that have a high level of popularity. This is finding products that are popular and have a large customer base. If you do this, you'll save time and effort because you won't have to create a product from scratch.

It is also important to look for products with high growth potential. You might choose to promote a book with a large following. Maybe you would like to promote a game that has been in existence for many years. These products are more likely to grow in popularity, making them ideal for affiliate marketing.

Another important tip is to avoid promoting products that aren't relevant to your niche. You wouldn't want to promote a weight loss program to someone who doesn't care about his or her appearance. Therefore, why would anyone promote a diet pill for someone who wants to lose weight.

Focusing on products that are easy-to-promote is the final thing. This means you don't have to spend too much time researching how to market a product. You should instead look for products with numerous reviews and testimonials.

These three tips will help you become a successful affiliate marketer.